雅思阅读精读别样解读 ,多精才算精?小编给大家带来了雅思阅读精读别样解读 ,希望能够帮助到大家,下面小编就和大家分享,来欣赏一下吧。

雅思阅读精读别样解读 多精才算精?

雅思考试任一科目拿高分都绝非易事,靠的不只是答题技巧,更需要有扎实的基础。对于雅思阅读来说,剑4-12刷2篇也不能保证你拿高分,但是如果在刷题之外,再认认真真精读10-20篇阅读文章则高分则十拿九稳。

首先怎么界定你的阅读是否够“精“呢?一个简单的衡量标准就是,你学得越累,学习的效果就越好。很扎心吧,但是这个衡量方式很有道理。你学得累,证明你调动的认知资源更多,花费的精力更多,专注度更高,因此学习效果自然更好。比如一篇文章,浮光掠影的大致泛读与逐句翻译相比,当然是翻译在时间精力上的花费更大。

泛读的时候很多宝宝感觉已经读懂了文章大致,但是在逐句分析、精读、甚至背诵的时候,你就会发现词汇的用法,句子成分的分析,甚至是上下文背景的交代等细节,你还存在大量无法全面理解的知识点。这也体现出了精读的重要性。

精读的方向主要有两个,第一个是reading for learning,也就是说通过精读而让你的英语变得更好,这也是大多数宝宝在学英语中经历的环节。第二个方向是learning for reading, 也就是学习如何进行阅读,更多的是学习一些阅读方式以及技巧。这两种最常见的阅读方向分别如何进行精读呢?

雅思阅读精读方法之reading for learning

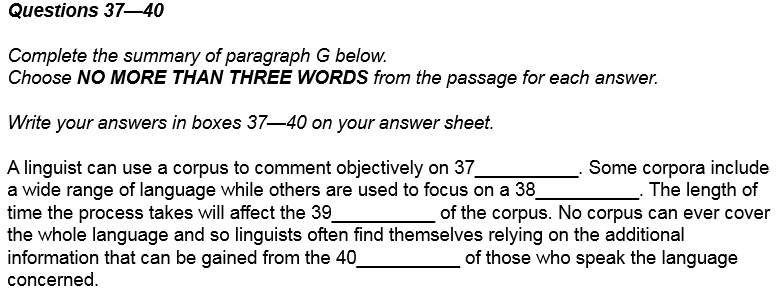

先说大家最熟悉的环节。雅思阅读的精读步骤是什么?首先,严格按照考试要求和时间把题目做完。也就是说,你可以20分钟做完一篇文章的题目,也可以用1小时把三篇题目一气呵成。做完之后当然要对一对答案,把错误标注出来。

第二步,开始对文本进行研读。研读过程中完成两件事:第一,整理文章出现的核心词汇与话题词汇(尤其是你经常见到但是还不认识的);第二,对照中文翻译文本进行逐句研读。方法是:先看一遍英文,脑子里过一下这句英文该怎么翻译;然后去看正确的中文翻译,检视一下你的翻译与正确翻译有多大出处;最后再看一遍英文原句,理顺一下句子成分。当你完成整篇文章的逐句研读后,你对文章的细节理解应该已经非常透彻了。当然如果你还有余力,你可以分析一下句间关系和段间关系,句子之间与段落之间的衔接方法。

第三步,分析题目。当你完整把握了全文细节以及结构之后,在仔细研究每道题的出处考点以及设问方式。当然你也可以借助很多雅思参考书中的提干解析。

第四步,也是最重要的一个步骤,英译汉逐句翻译。在文章中挑选3-5段你认为理解困难度最高的段落进行“落笔逐句翻译”。不管你是写在纸上还是打在word里,这个环节都一定不能省略。你会发现,即使你已经对着翻译文本逐句进行精读了,你在逐词落笔翻译中依然会对这句话的用词、句式、成分以及整个段落构成有新的认识。

第五步,不是必须要求,但是却能够快速拔升你的阅读乃至整个英语能力:背诵段落。选取你落笔翻译过的难段进行背诵,注意背诵的目的不是为了把他们用在写作或者口语考试里,否则难度太大,也会显得很突兀。背诵过程最重要培养的是你的英语思维能力。

以上就是reading for learning精读方式的5大步骤,总结起来就是做题目对答案——对照译文逐句精读——分析题目与答案——选段落笔翻译——选段背诵。

雅思阅读精读方法之learning for reading

learning for reading方向的精读方法,更加针对于阅读能力的集中提升,而非整个的语言能力。方法很简单。首先拿到一篇文章,先看它的题目,然后来个prediction,自己分析行文中可能会包括哪些内容。

举个栗子,一篇名为Jonsson’s dictionary 的文章,你尽量全面的猜测文章中会涉及到哪些内容。比如对Jonsson这个人的介绍,背景、学历、身份等,对dictionary的介绍,比如什么时候出版的,有什么特点,作者是谁,等等。

罗列出你的预测内容点之后再阅读文章,同时判断你的预测哪些在文中提到了,哪些是not given。所有你预测成功的内容,试着做一下段落matching,也就是说这些预测内容分别出现在文中的哪几段。最后有余力的宝宝们可以试试自己做一个summary,进行一下句子的改写。怎么改写?直接看学姐发给大家的雅思同义替换词学学套路。

大家发现了吗,这一系列的流程结束后,雅思阅读中的高频题型能力你都得到了提升。这也就是所谓的learning for reading。

精读也许很耗时,但是效果却很显著。学姐强烈建议备考的宝宝用心试一个月,你会看到很明显的阅读能力的提升。还等什么,动起来!

家带来的《雅思阅读精读别样解读 多精才算精?》的全部内容。想让自己的复习过程高效科学,让自己的考试从容优雅,答题速度快成闪电,正确率高过喜马拉雅,请持续关注小站雅思频道。祝2018年与雅思一战即分道扬镳。

雅思阅读素材积累:Game lessons

It sounds like a cop-out, but the future of schooling may lie with video games

SINCE the beginning of mass education, schools have relied on what is known in educational circles as "chalk and talk". Chalk and blackboard may sometimes be replaced by felt-tip pens and a whiteboard, and electronics in the form of computers may sometimes be bolted on, but the idea of a pedagogue leading his pupils more or less willingly through a day based on periods of study of recognisable academic disciplines, such as mathematics, physics, history, geography and whatever the local language happens to be, has rarely been abandoned.

Abandoning it, though, is what Katie Salen hopes to do. Ms Salen is a games designer and a professor of design and technology at Parsons The New School for Design, in New York. She is also the moving spirit behind Quest to Learn, a new, taxpayer-funded school in that city which is about to open its doors to pupils who will never suffer the indignity of snoring through double French but will, rather, spend their entire days playing games.

Quest to Learn draws on many roots. One is the research of James Gee of the University of Wisconsin. In 2003 Dr Gee published a book called "What Video Games Have to Teach Us About Learning and Literacy", in which he argued that playing such games helps people develop a sense of identity, grasp meaning, learn to follow commands and even pick role models. Another is the MacArthur Foundation's digital media and learning initiative, which began in 2006 and which has acted as a test-bed for some of Ms Salen's ideas about educational-games design. A third is the success of the Bank Street School for Children, an independent primary school in New York that practises what its parent, the nearby Bank Street College of Education, preaches in the way of interdisciplinary teaching methods and the encouragement of pupil collaboration.

Ms Salen is, in effect, seeking to mechanise Bank Street's methods by transferring much of the pedagogic effort from the teachers themselves (who will now act in an advisory role) to a set of video games that she and her colleagues have devised. Instead of chalk and talk, children learn by doing—and do so in a way that tears up the usual subject-based curriculum altogether.

Periods of maths, science, history and so on are no more. Quest to Learn's school day will, rather, be divided into four 90-minute blocks devoted to the study of "domains". Such domains include Codeworlds (a combination of mathematics and English), Being, Space and Place (English and social studies), The Way Things Work (maths and science) and Sports for the Mind (game design and digital literacy). Each domain concludes with a two-week examination called a "Boss Level"—a common phrase in video-game parlance.

Freeing the helots

In one of the units of Being, Space and Place, for example, pupils take on the role of an ancient Spartan who has to assess Athenian strengths and recommend a course of action. In doing so, they learn bits of history, geography and public policy. In a unit of The Way Things Work, they try to inhabit the minds of scientists devising a pathway for a beam of light to reach a target. This lesson touches on maths, optics—and, the organisers hope, creative thinking and teamwork. Another Way-Things-Work unit asks pupils to imagine they are pyramid-builders in ancient Egypt. This means learning about maths and engineering, and something about the country's religion and geography.

Whether things will work the way Ms Salen hopes will, itself, take a few years to find out. The school plans to admit pupils at the age of 12 and keep them until they are 18, so the first batch will not leave until 2016. If it fails, traditionalists will no doubt scoff at the idea that teaching through playing games was ever seriously entertained. If it succeeds, though, it will provide a model that could make chalk and talk redundant. And it will have shown that in education, as in other fields of activity, it is not enough just to apply new technologies to existing processes—for maximum effect you have to apply them in new and imaginative ways.

雅思阅读素材积累:The screw tightens

ONE can almost hear the gates clanging: one after the other the sources of funding for Europe's banks are being shut. It is a result of the highly visible run on Europe's government bond markets, which today reached the heart of the euro zone: an auction of new German bonds failed to generate enough demand for the full amount, causing a drop in bond prices (and prompting the Bundesbank to buy 39% of the bonds offered, according to Reuters).

Now another run—more hidden, but potentially more dangerous—is taking place: on the continents' banks. People are not yet queuing up in front of bank branches (except in Latvia's capital Riga where savers today were trying to withdraw money from Krajbanka, a mid-sized bank, pictured). But billions of euros are flooding out of Europe's banking system through bond and money markets.

At best, the result may be a credit crunch that leaves businesses unable to get loans and invest. At worst, some banks may fail—and trigger real bank runs in countries whose shaky public finances have left them ill equipped to prop up their financial institutions.

To make loans, banks need funding. For this, they mainly tap into three sources: long-term bonds, deposits from consumers, and short-term loans from money markets as well as other banks. Bond issues and short-term funding have been seizing up as the panic over government bonds has spread to banks (which themselves are large holders of government bonds). This blockage has been made worse by tighter capital regulations that are encouraging banks to cut lending (instead of raising capital).

Markets for bank bonds were the first to freeze. In the third quarter bonds issues by European banks only reached 15% of the amount they raised over the same period in the past two years, reckon analysts at Citi Group. It is unlikely that European banks have sold many more bonds since.

Short-term funding markets were next to dry up. Hardest hit were European banks that need dollars to finance world trade (more than one third of which is funded by European banks, according to Barclays). American money market funds, in particular, have pulled back from Europe. Loans to French banks have plunged 69% since the end of May and nearly 20% over the past month alone, according to Fitch, a ratings agency. Over the past six months, it reckons, American money market funds have pulled 42% of their money out of European banks. European money market funds, too, continue to reduce their exposure to France, Italy and Spain, according to the latest numbers from Fitch.

Interbank markets, in which banks lend to one another, are now also showing signs of severe strain. Banks based in London are paying the highest rate on three month loans since 2009 (compared with a risk-free rate). Banks are also depositing cash with the ECB for a paltry, but risk-free rate instead of making loans.

That leaves retail and commercial deposits, and even these may have begun to slip away. "We are starting to witness signs that corporates are withdrawing deposits from banks in Spain, Italy, France and Belgium," an anlayst at Citi Group wrote in a recent report. "This is a worrying development."

With funding ever harder to come by, banks are resorting to the financial industry's equivalent of a pawn broker: parking assets on repo markets or at the central bank to get cash. "We have no alternative to deposits and the ECB," says a senior executive at one European bank.

So far the liquidity of the European Central Bank (ECB) has kept the system alive. Only one large European bank, Dexia, has collapsed because of a funding shortage. Yet what happens if banks run out of collateral to borrow against? Some already seem to scrape the barrel. The boss of UniCredit, an Italian bank, has reportedly asked the ECB to accept a broader range of collateral. And an increasing number of banks are said to conduct what is known as "liquidity swaps": banks borrow an asset that the ECB accepts as collateral from an insurer or a hedge fund in return for an ineligible asset—plus, of course, a hefty fee.

The risk of all this is two-fold. For one, banks could stop supplying credit. To some extent, this is already happening. Earlier this week Austria's central bank instructed the country's banks to limit cross-border lending. And some European banks are not just selling foreign assets to meet capital requirements, but have withdrawn entirely from some markets, such as trade finance and aircraft leasing.

Secondly and more dangerously, as banks are pushed ever closer to their funding limits, one or more may fail—sparking a wider panic. Most bankers think that the ECB would not allow a large bank to fail. But the collapse of Dexia in October after it ran out of cash suggests that the ECB may not provide unlimited liquidity. The falling domino could also be a "shadow" bank that cannot borrow from the ECB.

Europe's leaders are certainly aware of the dangers—and are working on solutions. But it would not be the first time that their efforts are overtaken by events.

雅思阅读精读别样解读相关文章:

★ 雅思阅读怎样才算精读

★ 雅思A类阅读备考做到这5点才是基础

★ 雅思阅读练习方法

雅思阅读精读别样解读

上一篇:雅思阅读低分原因分析

下一篇:返回列表